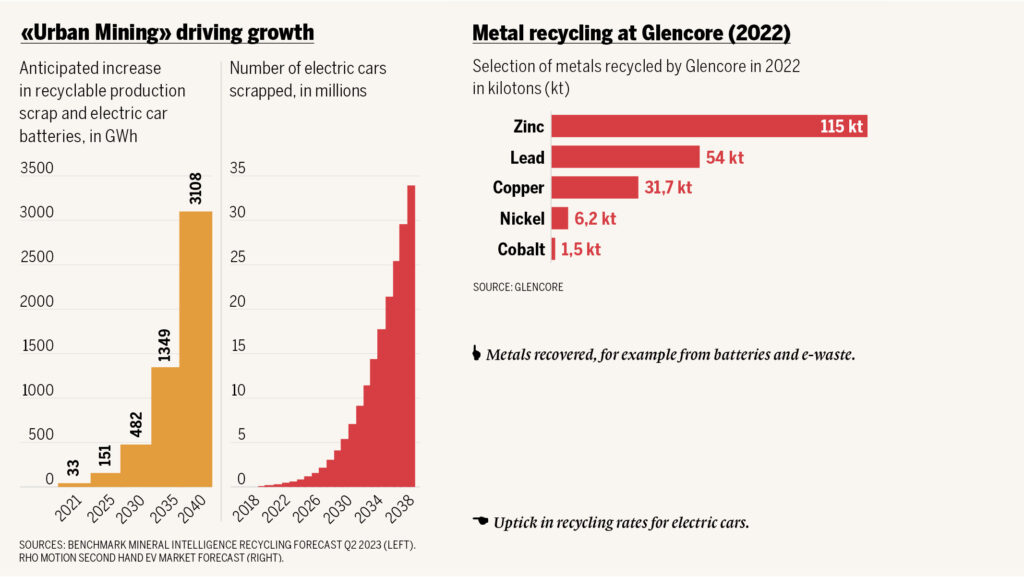

A UBS analyst report forecasts that Glencore’s recycling business will quadruple over the next five years and states that the company is “well-positioned” for this. This is partly because the company already owns the melting furnaces and refineries required to support this boom. The Horne melting plant in Canada, for example, already sources about 15 percent of its raw materials from e-waste, the analysts write.

Weltwoche spoke with Hendrik Fitschen, who is responsible for expanding Glencore’s recycling business in Europe.

Over his decade-plus at the company, the business economist first trained as a freight expert before specialising in metal reprocessing.

“Every battery recycling process starts with the mechanical processing of the batteries,” says Fitschen. The batteries are mechanically disassembled and shredded. During the shredding stage, copper, aluminium and plastic are separated from the black mass. This mass contains nickel, cobalt and lithium, i.e. raw materials that have been classified as critical by the EU due to the geographical concentration of their sources of supply and their economic importance (“critical raw materials”).

The black mass can be refined to separate the metals from each other in two different ways: by using either a pyrometallurgical process or a hydrometallurgical process. In the pyrometallurgical method, the black mass is melted down, Fitschen explains. This is a process that Glencore has been successfully running for years at its Sudbury facility in Canada. One disadvantage: the lithium is lost during the melting process, which reaches temperatures of over a thousand degrees Celsius. Hydrometallurgical processing enables lithium to be recovered, in addition to cobalt and nickel. “The hydrometallurgical process is a proven chemical approach that is already being operated on an industrial scale, especially in Asia. Europe is still lagging a little behind,” explains Fitschen. Glencore is hoping that expanding its recycling activities in Europe will change this and create a European circular solution that includes its pre-existing recycling plants and refineries.

But how does the environmental balance of a battery made of recycled metals stack up compared to one made of metals newly extracted via mining, known as “primary material”? Fitschen does not want to make any general statements with regard to the battery as a whole. “You have to look at the process end-to-end: which recycling process is used? What substances are needed for this, where do they come from, and where do they have to be sent to manufacture the battery?” The same applies to newly mined metals: “What is the environmental footprint of the mine in question, and what about the transport used?”.

In general, a regional cycle for handling batteries releases fewer emissions than newly extracted metals transported from South America and Africa to China and processed there into batteries before they find their way, say, to the West. In the US and Europe, Glencore is making investments to support the creation of regional raw material cycles for metals from automotive batteries. In April, the company announced one such project for Portugal and Spain in collaboration with the Spanish firm Iberdrola.