Economic opportunity at home is the only solution.

Bild: JEGAS RA - stock.adobe.com

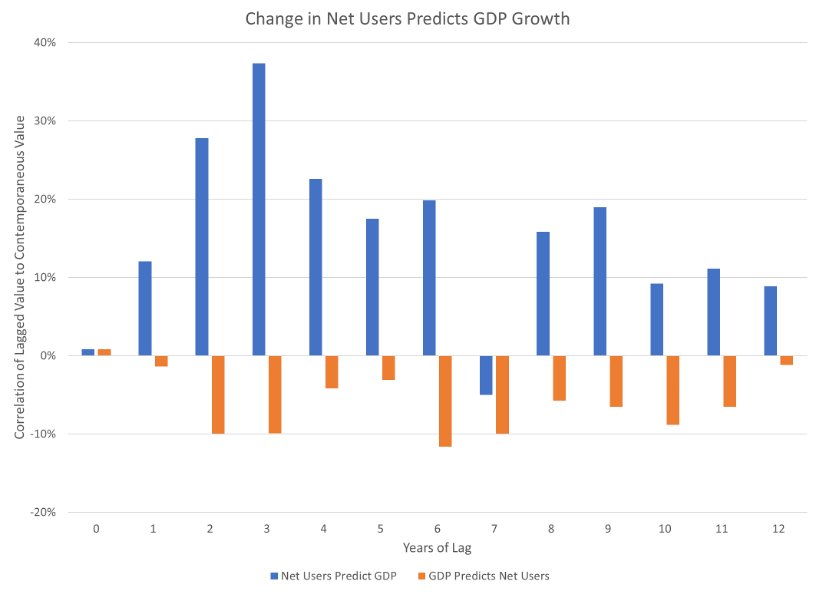

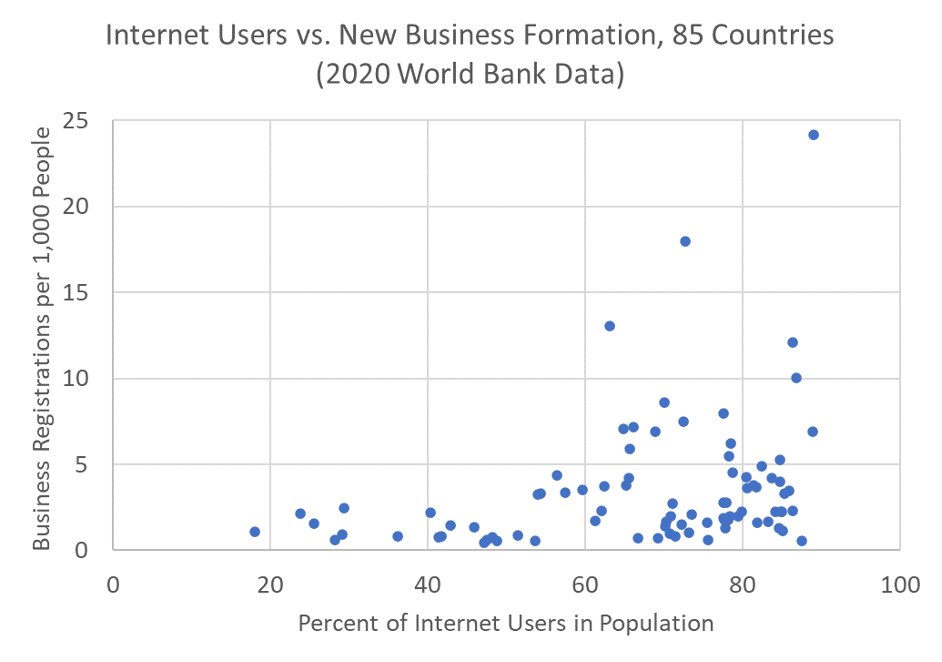

Migration is overwhelming Europe. Chinese investments in Africa might stop this development. Mobile broadband can turn marginalized people into actors in the global economy.

Bitte beachten Sie die Netiquette-Regeln beim Schreiben von Kommentaren.

Den Prozess der Weltwoche-Kommentarprüfung machen wir in dieser Erklärung transparent.

David P. Goldman und Uwe Parpart

David P. Goldman und Uwe Parpart